What Is Trade Credit Insurance for Beginners

Wiki Article

Some Known Details About What Is Trade Credit Insurance

Table of ContentsWhat Is Trade Credit Insurance for BeginnersHow What Is Trade Credit Insurance can Save You Time, Stress, and Money.Indicators on What Is Trade Credit Insurance You Should Know

Throughout the year, if any of those customers go breast or don't pay, after that we will certainly make the settlement. We check out the entire turnover of a business and also we finance the entirety. "What we're seeing via electronic platforms is that individuals can go online and can offer a solitary billing.

What the client can after that do is take the choice to guarantee that single billing. "At Euler Hermes, we think there's going to be a change in the method profession credit scores insurance is distributed.

Indicators on What Is Trade Credit Insurance You Should Know

Required a broker? See our guide to locating the best broker.

A producer with a margin of 4% that experiences a non-payment of 50,000 would require 25 equivalent sales to make up for a solitary instance of non-payment. Credit insurance coverage reduces versus this loss. You can reduce costs on credit rating info as that's covered, and you won't require to lose resources on chasing collections.

You may have the ability to negotiate beneficial terms with your click here to read vendors as a credit scores insurance coverage plan minimizes the impact of an uncollectable bill on them and also potentially the entire supply chain. Credit insurance is there to aid you stop and minimize your trading dangers, so you can create your service with the knowledge get redirected here that your accounts are secured.

An organization wished to expand sales with its present consumers but was not totally comfy using them greater credit report limits. They contacted Coface credit history insurance to cover the greater credit line so they might raise the amount of credit report provided to customers without threat - What is trade credit insurance. This allowed them grow incomes and also deliver even more earnings.

The Best Strategy To Use For What Is Trade Credit Insurance

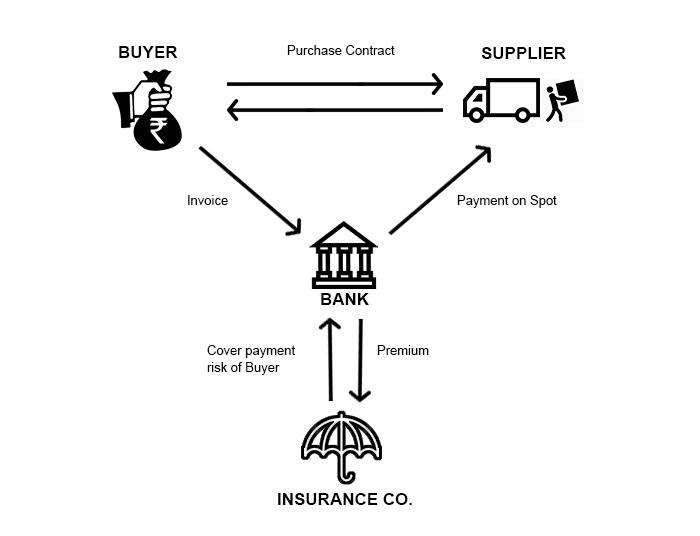

"From the first goal of offering convenience to our financial institutions, the service included depth to our service decisions." The communication permitted the business to analyze its clients' problem much more properly and has been an important device in business growth.Australian services owe around $950 billion to various other services. Which means it's necessary to have defenses in position to ensure that in the event a financial institution does not fulfill its responsibilities, view it the business can still redeem its money. Taking out trade credit score insurance policy is one means you can do this. Profession credit history insurance supplies cover when a client either comes to be financially troubled or does not pay its financial debts after a particular duration (which is established out in the insurance plan).

"In case a debt is unpaid, the policy owner might have the ability to assert up to 90 per cent of the quantity of that debt, considering any kind of unwanteds that might matter," he adds. When it concerns gathering the financial obligation, frequently the insurer will have its own financial debt collection company and will pursue the debt in support of the service.

Report this wiki page